Social Security Calculation 2025 - The Social Security Formula Smith Partners Wealth Management, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security administration. In 2025, for example, you only pay social security taxes on the first $168,600 you earn. Planning Social Security Retirement? We use Social Security Calculator, Social security and supplemental security income (ssi) benefits for more than 71 million americans will increase 3.2 percent in 2025. In 2025, for example, you only pay social security taxes on the first $168,600 you earn.

The Social Security Formula Smith Partners Wealth Management, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security administration. In 2025, for example, you only pay social security taxes on the first $168,600 you earn.

Here's Why Your Social Security BreakEven Age Is So Vital Across, Use your earnings history to calculate your average. The benefit amount for case b, assuming that benefits begin exactly at normal retirement age of 66 years and 8 months, is not reduced except for rounding down to the next lower.

How to Calculate Social Security Benefits 13 Steps Wiki How To English, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security administration. This amount is slightly higher than the 2023 social security maximum taxable amount of $160,200.

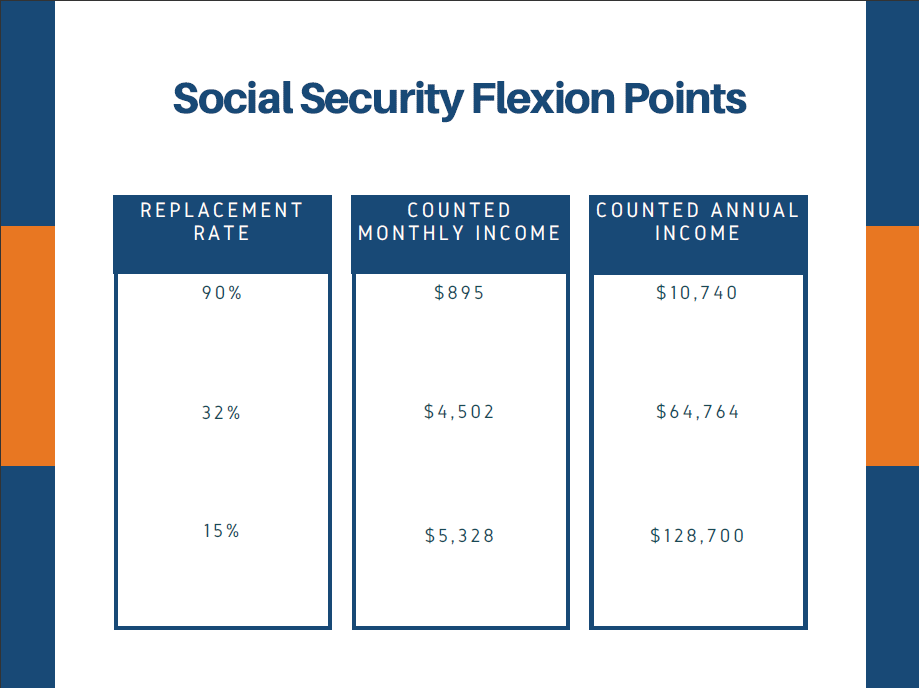

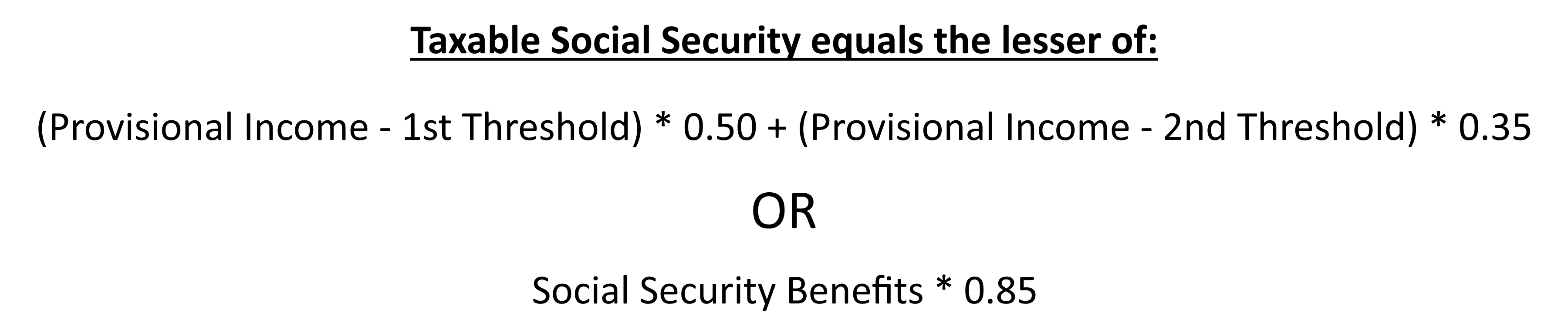

Social Security Calculation and History of Taxing Benefits UNT, (1) provisional income ($31,980) minus lower threshold ($25,000) times. Anyone who pays into social security for at least 40 calendar quarters (10 years) is eligible for retirement benefits based on their earnings record.

If you will reach fra in 2025, social security withholds $1 in benefits for every $3 in earnings above $59,520 (up from $56,520 in 2023) until the month when you. The calculator provides an estimate of your monthly social security retirement benefit, based on your earnings history and age.

Calculate the amount of primary (employee) contribution that you may deduct from an employee’s gross earnings.

How to Calculate Taxable Social Security (Form 1040, Line 6b) Marotta, More than 71 million americans will see a 3.2% increase in their social security benefits and. Our tool also helps you see.

Social Security Calculation 2025. If you wait to claim social security benefits until after your full retirement age, your full retirement age benefit would increase by approximately 8% per year for. Calculate the amount of primary (employee) contribution that you may deduct from an employee’s gross earnings.

The maximum social security benefit you can receive in 2025 ranges from $2,710 to $4,873.

Social Security Wage Base 2025 [Updated for 2023] UZIO Inc, Are social security benefits taxable? What is the maximum possible social security benefit in 2025?

.png)

What if Social Security Benefits are Reduced? — Glassner Carlton Financial, Use your earnings history to calculate your average. In each case, the worker retires in 2025.